Unlock Low Rates from hard money lenders in Atlanta Georgia

Unlock Low Rates from hard money lenders in Atlanta Georgia

Blog Article

The Influence of a Hard Money Financing on Realty Financing Techniques

In the facility field of property financing, tough Money car loans have emerged as a powerful device, supplying capitalists a quick path to funding. Nevertheless, this funding method, with its emphasis on home worth over customer creditworthiness, features its own set of one-of-a-kind obstacles. High rate of interest and brief repayment periods are amongst the truths investors must browse. Understanding the complexities of difficult Money loans is important for capitalists wanting to make best use of returns while mitigating dangers.

Comprehending the Idea of Hard Money Loans

Although usually misconstrued, tough Money loans play a vital duty in the realty market. They are temporary loans provided by exclusive capitalists or business, based on the value of the property being purchased as opposed to the consumer's creditworthiness. The funds are typically utilized for renovation or building of property residential properties. These finances are identified by their high rate of interest and much shorter payment durations compared to traditional finances. Tough Money financings are typically the go-to alternative for actual estate investors who require quick funding or those with poor credit score background. Comprehending the complexities of tough Money car loans is vital for any real estate capitalist or designer as it can open up brand-new methods for residential property financial investment and development.

The Advantages and disadvantages of Hard Money Loans in Real Estate

Tough Money lendings in genuine estate included their distinct collection of advantages and possible risks (hard money lenders in atlanta georgia). A close evaluation of these facets is vital for investors curious about this sort of financing. The following conversation will certainly aim to clarify the advantages and disadvantages, offering a detailed understanding of tough Money lendings

Reviewing Hard Money Advantages

In spite of the potential challenges, hard Money loans can use substantial advantages for actual estate investors. Furthermore, tough Money financings provide versatility. Custom-made Lending terms can be bargained based on the capitalist's special needs and job specifics.

Comprehending Potential Financing Threats

While tough Money finances offer attracting advantages, it is essential to understand the intrinsic risks entailed. Furthermore, the residential property, which serves as the Financing security, is at risk if settlement fails. The authorization of a Hard Money Loan is primarily based on the residential or commercial property value, not the customer's credit reliability, which could motivate dangerous monetary actions.

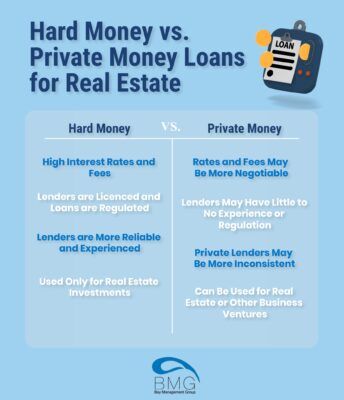

Comparing Tough Money Lendings With Typical Funding Options

Exactly how do hard Money finances compare with traditional funding options in the real estate industry? Tough Money finances, usually looked for by capitalists for fast, temporary financing, are identified by their quick approval and funding process. Tough Money lendings usually have a shorter term, typically around 12 months, while traditional fundings can extend to 15 to 30 years.

Case Studies: Successful Property Deals Funded by Hard Money Loans

Numerous success tales in the genuine estate industry highlight the tactical usage of tough Money fundings. As an example, a programmer in Austin, Texas safeguarded a Hard Money Financing to buy a worn out property. The quick financing enabled him to outbid competitors, and the residential or commercial property was efficiently refurbished and offered at a substantial profit. In one more situation, a real estate investor in Miami had the ability to shut a deal on a multi-unit residential building within days, thanks to the fast authorization process of a Hard Money Lending. These situations underscore the duty tough Money financings can play in promoting rewarding genuine estate bargains, confirming to their strategic importance in property financing.

Exactly how to Secure a Hard Money Loan: A Step-by-Step Guide

Safeguarding a Hard Money Finance, simply like the Austin programmer and Miami financier did, can be a significant game-changer in the genuine estate sector. After choosing a lending institution, the debtor needs to provide a compelling situation, usually by showing the prospective profitability of the residential property and great post to read their capacity to repay the Lending. When the lending institution approves the proposal and evaluates, the Financing contract is drawn up, signed, and funds are paid out.

Tips for Making Best Use Of the Advantages of Hard Money Loans in Property Investment

To make use of the complete possibility of tough Money lendings in realty investment, smart financiers employ a selection of strategies. One such strategy includes making use of the rapid authorization and funding times of difficult Money car loans to maximize financially rewarding deals that need fast activity. One more method is to make use of these fundings for property improvements, thus enhancing the value of the property and possibly accomplishing a greater price. useful reference Capitalists need to also bear in mind the Funding's problems and terms, guaranteeing they are ideal for their financial investment plans. Finally, it's prudent to develop healthy relationships with difficult Money lending institutions, as this can cause much more favorable Loan terms and prospective future financing chances. These approaches can maximize the advantages of tough Money loans in the property market.

Verdict

Finally, difficult Money finances can be a powerful device in an investor's financing arsenal, providing fast access to resources and helping with profit generation from improvement or procurement jobs. Nonetheless, their high-cost nature requires detailed due diligence and strategic planning. Investors must guarantee that potential returns justify the associated threats which they have the capability to take care of the brief payment timelines effectively.

These loans are characterized by their high rate of interest rates and shorter settlement durations contrasted to conventional lendings. Hard Money financings are usually the go-to choice for real estate financiers who require fast financing or those with inadequate credit scores background (hard money lenders in atlanta georgia). Understanding the ins and outs of difficult Money lendings is important for any kind of actual estate investor or developer as it can open up new opportunities for home investment and growth

Tough Money fundings typically have a shorter term, generally around 12 months, visit homepage while traditional fundings can prolong to 15 to 30 years. These situations underscore the role hard Money lendings can play in facilitating successful actual estate offers, attesting to their tactical significance in genuine estate financing.

Report this page